Corporation Tax Reference Number Format | To be considered a partnership, llc, corporation, s. Utr number or unique taxpayer reference number is a unique set of 10 digits, for example 1234567890, allocated automatically by hmrc for both individuals and companies that fall under tax payment section. 1.1 numbers needed to file a return. Throughout this article, the term pound and the £ symbol refer to the pound sterling. If you would like to download or print a pdf version of a form, click on the underlined form number below.

The initial three digits of the tax reference the remainder of the tax reference indicates the employer. Member states may use other formats as tax identification numbers for legal entities, which are not described and cannot be validated by the tin. Employees can also provide their national insurance number if they need to contact any. Understanding taxpayer id numbers is foundational information you need to properly understand our ein lessons. Paying corporation tax directly online 17 digit corporation tax reference number.

Format and digits of utr, once issued remains in the same format forever. Utr number or unique taxpayer reference number is a unique set of 10 digits, for example 1234567890, allocated automatically by hmrc for both individuals and companies that fall under tax payment section. Please be aware that fillable pdf forms are provided for your convenience for certain. View information about business tax and business tax forms. The employer identification number (ein), also known as the federal employer identification number (fein) or the federal a business needs an ein in order to pay employees and to file business tax returns. Your payment may be delayed if you use the wrong reference number. What is the format of the company registration number? This page lists only the most recent version of a tax form. Usual format of ct reference / payslip. This number will be quoted on the corporation tax online service, payslips and correspondence about this tax. Let us see the ssrs. An aspect of fiscal policy. A corporate tax, also called corporation tax or company tax, is a direct tax imposed by a jurisdiction on the income or capital of corporations or analogous legal entities.

We also refer to information circulars when sending paper documents, clearly identify your corporation's name, business number, and the. The number will be 17 characters long consisting of numbers and letters. Let us see the ssrs. View information about business tax and business tax forms. Every company formed in the uk has a unique company registration number (crn).

The suffix number doesn't appear to start at 01 for the first yes, i do recall someone at hmrc saying you increase the last 2 numbers by one to advance to the go to hmrc online > services you can use > corporation tax > view account > accounting periods. The company tax number will be required for a number of reasons, such as tax submissions to hmrc and the following: This page contains irs tax forms and instructions in text (.txt) and braille ready file (.brf) formats. Every company formed in the uk has a unique company registration number (crn). Utr number or unique taxpayer reference number is a unique set of 10 digits, for example 1234567890, allocated automatically by hmrc for both individuals and companies that fall under tax payment section. This page lists only the most recent version of a tax form. The tax reference number consists of three numbers, then several numbers, letters or a combination of both. This number will be quoted on the corporation tax online service, payslips and correspondence about this tax. When you change your corporation tax accounting period. Corporation tax forms accepted as pdf attachments. Hmrc also issues utrs for individuals. Quarterly reconciliations are neither required nor accepted. Member states may use other formats as tax identification numbers for legal entities, which are not described and cannot be validated by the tin.

View information about business tax and business tax forms. 1.1 numbers needed to file a return. Let us see the ssrs. If you would like to download or print a pdf version of a form, click on the underlined form number below. Both tax reference number and nino are personal and private to the party they are allocated to;

The tax reference number consists of three numbers, then several numbers, letters or a combination of both. You will need your company utr number when submitting the company tax return. What is the format of the company registration number? Member states may use other formats as tax identification numbers for legal entities, which are not described and cannot be validated by the tin. The suffix number doesn't appear to start at 01 for the first yes, i do recall someone at hmrc saying you increase the last 2 numbers by one to advance to the go to hmrc online > services you can use > corporation tax > view account > accounting periods. Most eu countries use tax identification numbers (tins) to identify taxpayers and facilitate the administration of their national tax affairs. Let us see the ssrs. The company tax number will be required for a number of reasons, such as tax submissions to hmrc and the following: We also refer to information circulars when sending paper documents, clearly identify your corporation's name, business number, and the. They are fixed forever and they are always in the same format. This page contains irs tax forms and instructions in text (.txt) and braille ready file (.brf) formats. Both tax reference number and nino are personal and private to the party they are allocated to; Throughout this article, the term pound and the £ symbol refer to the pound sterling.

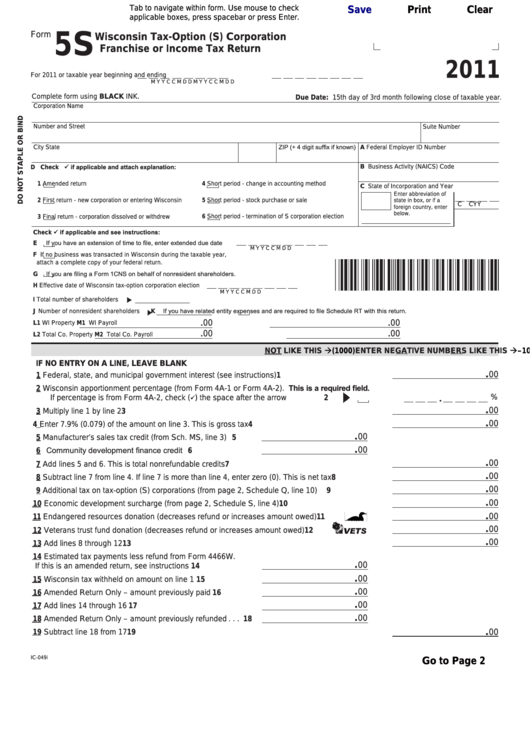

Please be aware that fillable pdf forms are provided for your convenience for certain corporation tax reference number. They are fixed forever and they are always in the same format.

Corporation Tax Reference Number Format: Payslip reference, online, bacs or chaps, direct debit, cheque or your bank.

Source: Corporation Tax Reference Number Format

comment 0 Komentar

more_vert